Price Alert Feature Is Now Live

In crypto trading, market conditions can shift instantly. Whether you are executing short-term strategies or managing mid-to-long-term positions, receiving timely alerts at critical price levels or during significant market movements is essential for improving trading efficiency.

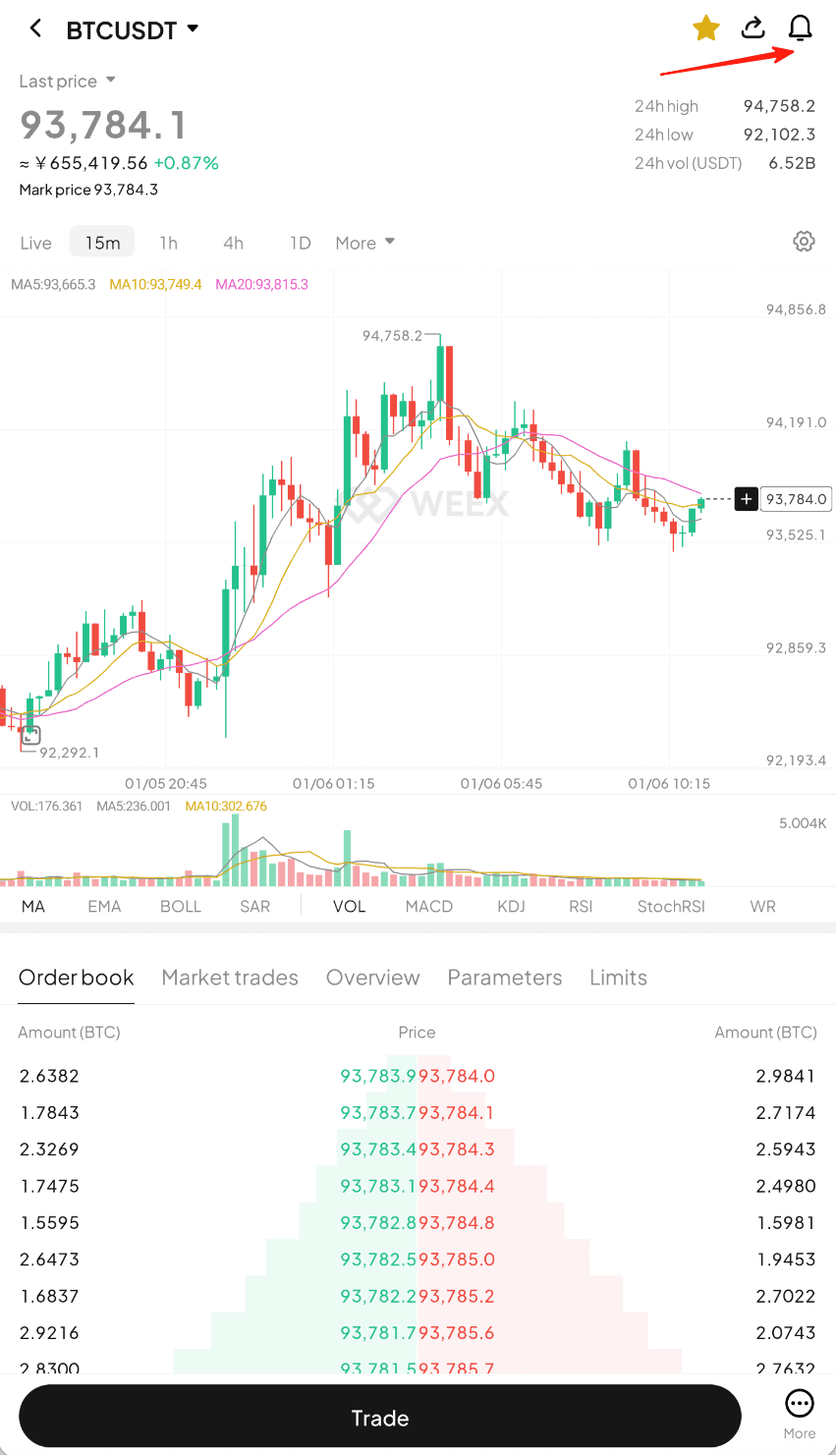

To help users stay on top of market dynamics more effectively, WEEX has launched the Price Alert feature, now fully supported on both the App and Web. Users can configure multiple alert conditions based on their trading needs and receive notifications as soon as the market reaches key thresholds—reducing the need for constant screen monitoring.

Key Features

Multiple Alert Conditions for Core Trading Scenarios

The Price Alert feature supports a wide range of trigger conditions to accommodate different trading styles, including:

- Price Reached: Triggered when the latest price reaches the set price

- Price rises to: Triggered when the latest price is higher than or equal to the set price

- Price drops to: Triggered when the latest price is lower than or equal to the set price

- Gain reaches: Triggered when the price increase exceeds or equals the set percentage

- Loss reaches: Triggered when the price decrease exceeds or equals the set percentage

- 24h gain reaches: Triggered when the price increase in the past 24 hours exceeds or equals the set percentage

- 24h loss reaches: Triggered when the price decrease in the past 24 hours exceeds or equals the set percentage

Whether you are monitoring key price levels, tracking trend changes, or responding to rapid short-term price movements, Price Alerts help you stay informed in real time.

Seamless App & Web Experience

Price Alerts are fully supported on both the WEEX App and Web platform, with a consistent interface and interaction logic.

Users can create, view, and manage alerts on either platform, with configurations synced in real time, offering flexibility across different usage scenarios.

Supports Both Spot and Futures Markets

WEEX Price Alerts support both Spot and Futures trading scenarios.

Whether you are tracking spot price movements or monitoring futures market volatility, all alerts can be configured and managed within a unified alert system, without switching workflows or learning different interaction patterns.

This unified design allows users to manage market notifications efficiently across multiple trading scenarios, enhancing the overall trading experience.

Smart Validation for More Effective Alerts

To ensure accuracy and usability, WEEX applies smart validation rules when setting alerts, including checks on price precision, percentage ranges, and alert logic based on the selected trigger type.

This helps reduce invalid alerts and accidental configurations, improving the overall experience.

Timely Notifications at Critical Moments

Once an alert condition is met, notifications are sent via App push notifications and in-platform messages, allowing users to quickly stay informed of important price movements and make timely decisions.

Feature Overview

Setting up a Price Alert is simple and intuitive:

- Select a trading pair

- Choose an alert type

- Enter the target price or percentage change

- Save to activate the alert

All active alerts can be viewed and managed in the alert list, where users can delete individual alerts or manage them in batches.

Get Started Now

The Price Alert feature is now available on both the WEEX App and Web. Set up alerts that match your strategy and stay informed as the market moves.

Frequently Asked Questions (FAQ)

- Which trading pairs support Price Alerts?

Price Alerts are available for trading pairs currently supported on the platform. Please refer to the interface for the latest availability.

- Will Price Alerts trigger repeatedly?

If an alert is set to daily or recurring reminders, it may trigger multiple times. If set as a one-time alert, it will trigger only once and expire after being triggered.

- What notification methods are supported?

Notifications are delivered through App push notifications and in-platform messages.

- Are Price Alerts synchronized between App and Web?

Yes. Price Alerts are fully synchronized across the App and Web, allowing cross-platform management.

Note:

In extreme market conditions, there may be a slight delay in alert delivery.

You may also like

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…

Average Bitcoin ETF Investor Turns Underwater After Major Outflows

Key Takeaways: U.S. spot Bitcoin ETFs hold approximately $113 billion in assets, equivalent to around 1.28 million BTC.…

Japan’s Biggest Wealth Manager Adjusts Crypto Strategy After Q3 Setbacks

Key Takeaways Nomura Holdings, Japan’s leading wealth management firm, scales back its crypto involvement following significant third-quarter losses.…

CFTC Regulatory Shift Could Unlock New Opportunities for Coinbase Prediction Markets

Key Takeaways: The U.S. Commodity Futures Trading Commission (CFTC) is focusing on clearer regulations for crypto-linked prediction markets,…

Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In?

Key Takeaways Hong Kong’s financial regulator, the Hong Kong Monetary Authority (HKMA), is on the verge of approving…

BitRiver Founder and CEO Igor Runets Detained Over Tax Evasion Charges

Key Takeaways: Russian authorities have detained Igor Runets, CEO of BitRiver, on allegations of tax evasion. Runets is…

Crypto Investment Products Struggle with $1.7B Outflows Amid Market Turmoil

Key Takeaways: The recent $1.7 billion outflow in the crypto investment sector represents a second consecutive week of…

Why Is Crypto Down Today? – February 2, 2026

Key Takeaways: The crypto market has seen a downturn today, with a significant decrease of 2.9% in the…

Nevada Court Temporarily Bars Polymarket From Offering Contracts in the State

Key Takeaways A Nevada state court has temporarily restrained Polymarket from offering event contracts in the state, citing…

Bitcoin Falls Below $80K As Warsh Named Fed Chair, Triggers $2.5B Liquidation

Key Takeaways Bitcoin’s price tumbled below the crucial $80,000 mark following the announcement of Kevin Warsh as the…

Strategy’s Bitcoin Holdings Face $900M in Losses as BTC Slips Below $76K

Key Takeaways Strategy Inc., led by Michael Saylor, faces over $900 million in unrealized losses as Bitcoin price…

Trump-Linked Crypto Company Secures $500M UAE Investment, Sparking Conflict Concerns

Key Takeaways A Trump-affiliated crypto company, World Liberty Financial, has garnered $500 million from UAE investors, igniting conflict…

Billionaire Michael Saylor’s Strategy Buys $75M of More Bitcoin – Bullish Signal?

Key Takeaways Michael Saylor’s firm, Strategy, has significantly increased its Bitcoin holdings by acquiring an additional 855 BTC…

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…