Unlocking the Future: How ERC-8004 Complements x402 in Building Trust for AI Agents

Key Takeaways

- ERC-8004 acts as a trust and identity layer for AI Agents, solving credibility issues in a decentralized world, much like a blockchain-based registry for verification.

- While x402 handles seamless payments between AI Agents, ERC-8004 ensures those interactions are built on verifiable reputations, creating a complete ecosystem for autonomous AI economies.

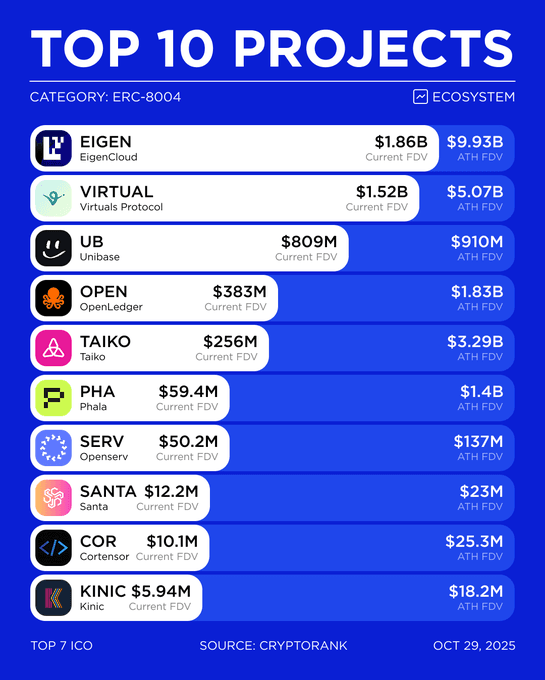

- Projects like Taiko, EigenLayer, and Unibase are poised to benefit from ERC-8004 by providing infrastructure for low-cost execution, security, and memory storage in AI Agent networks.

- The synergy between x402 and ERC-8004 could accelerate AI Agent adoption, with potential explosions in value similar to x402’s recent 137-fold trading volume surge.

- Investors should watch for integrations and announcements, such as those at Devconnect on November 21, as they may signal the next wave of opportunities in this emerging narrative.

Imagine stepping into a bustling digital marketplace where AI Agents hustle like entrepreneurs in a vibrant city square. They’re negotiating deals, sharing expertise, and getting paid on the fly. But without trust, it’s chaos—scammers lurk in every corner, and genuine talent gets lost in the noise. That’s where ERC-8004 steps in, not as a rival to the payment powerhouse x402, but as its perfect partner. If x402 is the wallet that makes transactions effortless, ERC-8004 is the ID card and credit score that ensures everyone plays fair. Together, they’re laying the foundation for a thriving AI Agent economy on the blockchain. As we dive into this, you’ll see why this duo is capturing the imagination of the crypto world, especially with the buzz building around them as of October 28, 2025.

Let’s rewind a bit to understand the excitement. Just a couple of weeks ago, x402 exploded onto the scene. Data from tracking platforms shows trading volumes in its ecosystem skyrocketing 137 times over. The first token in its orbit, PING, catapulted from nothing to a $30 million market cap in days. Influencers were all over it, dissecting everything from tech specs to project breakdowns. Back when early analyses highlighted potentials like PayAI, the market was quiet. In today’s fast-paced crypto landscape, where narratives flip quicker than you can refresh your feed, spotting these trends early is key to snagging those prime assets.

Fast forward to now, and social feeds are flooded with new x402 projects popping up every minute. If you’re just tuning in, it might feel like you’ve missed the boat—not because the protocol lacks promise, but because the low-hanging fruit has been picked. Yet, amid the frenzy, savvy observers are noticing another player gaining traction in English-speaking crypto circles: ERC-8004. What’s intriguing is the overlap. One of ERC-8004’s proponents, Davide Crapis from the Ethereum Foundation’s dAI team, mentioned in a September interview that the standard would support various payment methods, with x402 extensions enhancing developer experiences. Payments? Isn’t that x402’s domain? Are they competitors or allies?

Digging deeper, it turns out the same minds are pushing both. In early October, when the Ethereum Foundation finalized ERC-8004, signatories included MetaMask’s Marco De Rossi, Google’s Jordan Ellis, and Coinbase’s Erik Reppel—who also created x402. One person steering two protocols? There’s a method to this madness. While x402’s surge highlights the massive potential in AI Agent payments, ERC-8004 might be the underrated piece completing the puzzle. As the crowd chases payment plays, the real gems could lie elsewhere—in trust and identity.

The Core Problem ERC-8004 Solves: Giving AI Agents a Verifiable Identity

To grasp ERC-8004, we need to zoom in on a fundamental snag in the AI Agent economy. Picture your personal AI assistant tackling a big job, like prepping a market analysis for your product launch. It’s smart, but not omnipotent, so it outsources: one Agent for data scraping, another for competitor breakdowns, a third for visuals. With x402, paying them is a breeze—USDC transfers happen in code lines. But before the money flows, trust issues loom large. Which of these “expert” Agents are legit? What’s their track record—glowing reviews or a trail of complaints?

It’s like operating in a world without online marketplaces, review sites, or business registries. Every deal is a leap of faith, every collaboration a risk. In essence, ERC-8004 serves as the blockchain’s all-in-one “business bureau, credit agency, and certification hub” for AI Agents. It assigns each one an on-chain ID, credit history, and skill verification—immutable, queryable by anyone.

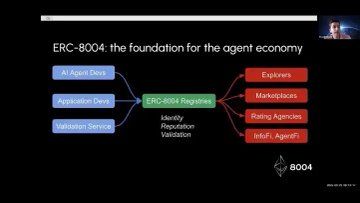

This proposal hit the scene on August 13, courtesy of Davide Crapis, Marco De Rossi, and Jordan Ellis, who’s tied to Google’s Agent-to-Agent initiatives. Essentially, it layers trust onto Google’s A2A framework. The Ethereum Foundation calls it a “trusted neutral rail” for AI Agents. Stripping away the code jargon, ERC-8004 boils down to three streamlined on-chain registries. Think of it as an NFT linking to a standardized “Agent card” with details like name, skills, endpoints, and metadata. Open standards mean any browser or marketplace can index it, enabling permissionless discovery across platforms.

Reputation signals are public goods, so anyone can build scoring systems on top. This creates verifiable credentials—an Agent claiming financial analysis prowess can cryptographically prove it ran specific models and delivered results. Let’s make this concrete with an example. Suppose a trading platform’s AI needs weekly DeFi reports but lacks the chops. It queries the ERC-8004 registry, finds rated specialists, hires them via smart contracts, verifies outputs, and pays out. No humans needed—the trust layer handles the vetting.

Bridging the Gap: How ERC-8004 and x402 Work Hand-in-Hand

So, does this tie back to x402? Absolutely—in a complementary way. x402 tackles payments, letting AI Agents handle micro-transactions frictionlessly. ERC-8004 addresses trust, making identities and reputations traceable on-chain. You can’t have a self-sustaining AI economy without both; it’s like having money without knowing who you’re dealing with.

Think of x402 as the standard for paying per API call, streamlining fees. ERC-8004 is the registry where Agents list themselves with wallets and verifiable data. This fits into the broader “crypto x AI” narrative. Discovery? ERC-8004’s registry logs identities on Ethereum. Communication? x402 enables on-chain payments, alongside protocols like Google’s A2A. Verification? Agents prove actions, perhaps stored with data availability focus.

Influencers on social platforms have mapped this out compellingly, showing how these pieces interlock to uncover more opportunities. In short, they’re not rivals—they’re collaborators building the full picture of an AI-driven economy. For a quick visual, imagine a flowchart where x402 flows payments and ERC-8004 anchors trust, amplifying each other.

Spotlight on Projects Thriving Under the ERC-8004 Narrative

When x402 blew up, tokens like PING led the charge. But ERC-8004’s ripple effects span layers—from base infrastructure to apps—each with unique angles. Understanding these beats blindly chasing tickers.

Take Taiko, an L2 execution layer. Why would a scaling solution care? AI Agents need cheap, fast chains; mainnet fees could hit dollars per identity update, pricing out Agents. Taiko deploys ERC-8004 registries on L2, slashing costs. Their contract went live on October 24, potentially becoming a hub for Agent action.

Then there’s EigenLayer, bolstering security. What if validators cheat? Stake and slash—pledge ETH, lose it for false claims. EigenLayer weaves ERC-8004 into over 200 AVS setups, each a potential Agent verification service. More Agents mean more transactions and revenue; it’s classic infrastructure play.

S.A.N.T.A. bridges payments, sitting at the x402-ERC-8004 crossroads. It handles transactions when one Agent discovers another via registry and pays via x402, even cross-chain—like a Solana Agent hiring from Ethereum.

Unibase adds memory—Agents need to recall past interactions. It ties persistent storage to ERC-8004 identities, letting them build experience. By October 26, it integrated x402 and ERC-8004 on BNB Chain, leading the pack.

Virtuals, an AI Agent token launchpad, uses bonding curves for creating and trading. With over 1,000 projects and $20 million daily volume, it tackles inter-Agent recognition. Recent updates support ERC-8004 fully, auto-assigning identities and reputations to launches. Watch how it evolves with launchpad mechanics.

Overall, x402 fixes payments, ERC-8004 builds trust. x402 took five months to ignite; ERC-8004 might be quicker. Keep an eye on November 21’s Devconnect, with its Trustless Agents Day—demos could spark hype. By year’s end, x402 projects might integrate ERC-8004, creating synergies where the whole exceeds the parts.

For conservative folks, big-cap infra like those mentioned offer stability. Risk-takers? Track small-caps and newcomers. It’s been ages since a tech-driven story gripped crypto like this. Will x402 and ERC-8004 fade or reshape the landscape? The market decides.

As of October 28, 2025, the buzz is intensifying. Google searches for “What is ERC-8004?” have surged, often paired with “ERC-8004 vs x402” or “AI Agent trust protocols,” reflecting curiosity about their interplay. On Twitter, discussions spike around #ERC8004, with threads debating its role in AI economies—posts from influencers like @soubhik_deb gain traction, echoing the original logic. Recent updates include Ethereum Foundation tweets confirming ERC-8004’s adoption in new L2s, and a Virtuals announcement on enhanced integrations, boosting community sentiment. Even platforms like WEEX, known for their robust support of emerging crypto narratives, are aligning with these developments by offering seamless trading for related tokens, enhancing user trust and accessibility in this space. This brand alignment positions WEEX as a go-to for investors exploring AI Agent opportunities, underscoring their commitment to innovative, secure ecosystems.

To wrap this up, ERC-8004 isn’t just another standard—it’s the trust glue making x402’s payment magic truly autonomous. As AI Agents evolve, this partnership could unlock unprecedented value, much like how e-commerce boomed with secure identities. Whether you’re an investor or builder, diving in now feels like catching the wave early.

FAQ

What is ERC-8004 and how does it differ from x402?

ERC-8004 is a blockchain standard that provides AI Agents with verifiable identities and reputations, focusing on trust. Unlike x402, which streamlines payments, ERC-8004 ensures interactions are credible, complementing rather than competing.

Why is trust important for AI Agents in crypto?

Without trust, AI Agents risk scams and unreliable collaborations, stalling the economy. ERC-8004’s registry offers immutable verification, like a digital credit system, enabling secure, autonomous dealings.

Which projects are benefiting from ERC-8004?

Key players include Taiko for low-cost L2 execution, EigenLayer for security via staking, S.A.N.T.A. for payment bridging, Unibase for memory storage, and Virtuals for token issuance—all leveraging ERC-8004’s trust layer.

How can ERC-8004 impact investment opportunities?

By solving trust issues, it could amplify x402’s growth, creating synergies. Investors might see value in infra projects or new apps, especially with events like Devconnect potentially triggering hype.

Is ERC-8004 ready for mainstream adoption as of 2025?

As of October 2025, integrations are advancing, with deployments on chains like Taiko and updates from projects like Virtuals. While early, its synergy with x402 suggests accelerating adoption in AI Agent ecosystems.

You may also like

AI Trading's Ultimate Test: Empower Your AI Strategy with Tencent Cloud to Win $1.88M & a Bentley

AI traders! Win $1.88M & a Bentley by crushing WEEX's live-market challenge. Tencent Cloud powers your AI Trading bot - can it survive the Feb 9 finals?

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…

Average Bitcoin ETF Investor Turns Underwater After Major Outflows

Key Takeaways: U.S. spot Bitcoin ETFs hold approximately $113 billion in assets, equivalent to around 1.28 million BTC.…

Japan’s Biggest Wealth Manager Adjusts Crypto Strategy After Q3 Setbacks

Key Takeaways Nomura Holdings, Japan’s leading wealth management firm, scales back its crypto involvement following significant third-quarter losses.…

CFTC Regulatory Shift Could Unlock New Opportunities for Coinbase Prediction Markets

Key Takeaways: The U.S. Commodity Futures Trading Commission (CFTC) is focusing on clearer regulations for crypto-linked prediction markets,…

Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In?

Key Takeaways Hong Kong’s financial regulator, the Hong Kong Monetary Authority (HKMA), is on the verge of approving…

BitRiver Founder and CEO Igor Runets Detained Over Tax Evasion Charges

Key Takeaways: Russian authorities have detained Igor Runets, CEO of BitRiver, on allegations of tax evasion. Runets is…

Crypto Investment Products Struggle with $1.7B Outflows Amid Market Turmoil

Key Takeaways: The recent $1.7 billion outflow in the crypto investment sector represents a second consecutive week of…

Why Is Crypto Down Today? – February 2, 2026

Key Takeaways: The crypto market has seen a downturn today, with a significant decrease of 2.9% in the…

Nevada Court Temporarily Bars Polymarket From Offering Contracts in the State

Key Takeaways A Nevada state court has temporarily restrained Polymarket from offering event contracts in the state, citing…

Bitcoin Falls Below $80K As Warsh Named Fed Chair, Triggers $2.5B Liquidation

Key Takeaways Bitcoin’s price tumbled below the crucial $80,000 mark following the announcement of Kevin Warsh as the…

Strategy’s Bitcoin Holdings Face $900M in Losses as BTC Slips Below $76K

Key Takeaways Strategy Inc., led by Michael Saylor, faces over $900 million in unrealized losses as Bitcoin price…

Trump-Linked Crypto Company Secures $500M UAE Investment, Sparking Conflict Concerns

Key Takeaways A Trump-affiliated crypto company, World Liberty Financial, has garnered $500 million from UAE investors, igniting conflict…

AI Trading's Ultimate Test: Empower Your AI Strategy with Tencent Cloud to Win $1.88M & a Bentley

AI traders! Win $1.88M & a Bentley by crushing WEEX's live-market challenge. Tencent Cloud powers your AI Trading bot - can it survive the Feb 9 finals?

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…