Why Should I Short SOL?

Original Author: The Giver

Original Translation: Ismay, BlockBeats

Editor's Note: This article provides an in-depth analysis of Solana's recent performance, discussing potential challenges from supply events, competitive pressures, complacency, among other perspectives, and predicts the future market trend. The author, through data and market phenomena, reveals Solana's potential concerns in terms of fund flows, ecosystem competition, and investor behavior, while also highlighting the changing trend of marginal buying and selling pressure in the market.

The following is the original content:

Here are some brief thoughts on Solana, mainly discussing why I believe Solana may underperform compared to other assets in December (I believe this trend has already started but will continue).

I opened a short position around ~$235-240 and believe this is the last excellent asymmetric opportunity of the year. However, it should be noted that I also hold short positions on other assets (such as Bitcoin, as the price gap between Saylor's buy-in price and the ETF is widening; also, I think if Ethereum falls, its downward trend may last even longer).

In summary, most of Solana's performance this year has not truly been tested, and its main driving force is running out (or in the process of running out).

Why will SOL underperform?

In my view, the real factors that have driven Solana to become the best-performing asset in the YTD among scalable assets this year include the following:

1. A more active and diversified ecosystem than its competitors, with fast transaction speeds;

2. The most powerful "casino" environment that has attracted many meme participants willing to use SOL as a unit of account;

3. Mid-year inflows — I believe many fund managers and large liquidity participants have been squeezed out due to the lack of ETH ETF heat, experiencing some form of "existence crisis" in future asset allocation.

Today, I believe the above three main driving forces have weakened and are highly vulnerable to shocks, with a significant amount of excess froth still needing to be trimmed. Here are my specific reasons:

As a speed- and diversity-focused leading L1, Solana faces a strong threat from HYPE and ETH/Base

The rise of these threats has been unexpected and remains inadequately addressed.

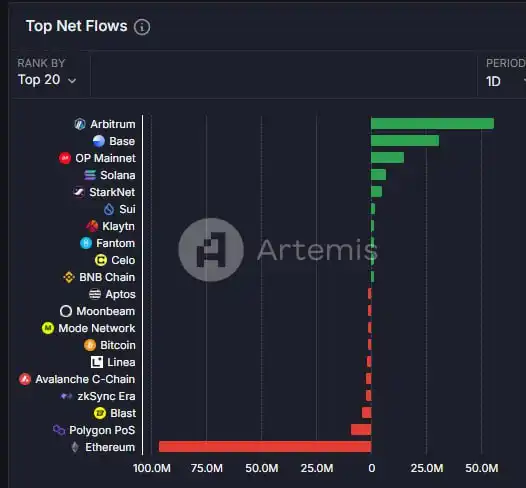

The chart below shows Artemis traffic data, where you can choose to view it over a 1-week or 1-month period. This is the most significant instance this year of Solana's capital flow shifting to EVM, a shift that is reflected not only in traffic. We can also observe this in popular domain use cases, such as the meme coin sector in the AI domain—previously considered top-tier projects like GOAT, FARTCOIN, ZEREBRO, and AI16Z have all halved in valuation during this period, while the VIRTUAL and proxy ecosystems have flourished.

Furthermore, I believe Solana has not faced a true competitor in the L1 space for quite some time. While the HYPE is still in its early stages, its pursuit of democratizing ownership and the team's demonstrated strength are attractions that cannot be ignored in the short term.

Solana has yet to experience a true supply shock event by 2024

In contrast, other major assets have already undergone severe tests, such as Bitcoin's MTGOX incident and regulatory issues in Germany, as well as Ethereum's ETF launch. Solana has almost been unaffected in this regard, with only a brief fluctuation during the Jump sell-off earlier this summer, quickly brushed aside as ETH's larger retracement diverted attention.

The period of the last few months has been Solana's time to shine as a high beta asset to Bitcoin, capturing much of the capital flow from Ethereum (a trend that has gradually dissipated) while attracting attention far beyond lackluster, unappealing small-cap altcoins.

In the realm of liquid funds, for the 2024 fiscal year, GPs should have only two options for realizing cash distributions:

1. Distribute based on a percentage of realized gains;

2. Distribute based on a percentage of unrealized gains but subject to clawback adjustment based on the prior year's high watermark.

In either case, given Solana's outstanding performance last year, I believe fund managers would lean toward selling SOL, reasons for which may include:

a) As the best-performing asset of the year, it has seen a significant price increase;

b) It is believed that parts of the portfolio that have previously underperformed still have untapped upside potential and are more worthy of holding, while also observing other altcoins that have shown trend strength recently on the H1/H4/1 timeframes to capture gains.

Furthermore, this trend is also being driven by the hype around the Galaxy Auction (SOL cost basis at $80-100). Fund managers participating in the auction can profit in the following ways:

For example, selling one-third of the locked supply purchased near historical highs and then "reclaiming" these tokens in the first unlock event in March of next year to realize the price difference in nominal value.

The exit liquidity of the SOL ETF weakened due to the rise of established tokens and the potential impact of the XRP ETF

XRP's performance is being driven by two main factors:

a) It is considered the asset most likely to launch an ETF product after ETH, closely linked with Bitwise;

b) Rumors of the U.S. cryptocurrency capital gains tax dropping to 0%.

Considering XRP's track record (as one of the earliest crypto assets) and SEC Chair Gary Gensler's resignation, even if the probability of an XRP ETF launch remains on par with or slightly lower than SOL, it is undeniable that it is diverting market share that originally belonged entirely to SOL.

Complacency

Although this sentiment is difficult to quantify precisely, intuitively, I believe Solana's arrogance has reached a bottleneck, contrasting the situation from a few years ago — back then, ETH caught up with SOL head-on due to its superior position, and that position acted as an impenetrable moat.

Here are some typical examples:

1. "Network Expansion vs. L2"; DRIFT compared to HL, demonstrating an "incorruptible" attitude;

2. Many claim "no one would ever want to bridge from Solana to Base," despite clear counterexamples;

3. Some users who were staunch supporters of ETH surrendered completely a few weeks before ETH's 35% surge, with some suddenly strongly predicting that the target price for ETHSOL would plummet to very low levels (e.g., 0.027 ETHSOL).

Summary

In the next 30 days, I believe the attractiveness of Solana to marginal buyers is at its weakest point this year (ETF liquidity significantly lags behind ETH; the attention on altcoins is more diversified than before), while the selling pressure from marginal sellers is at its strongest (profit-taking; users who have made significant gains through memes or holding SOL choosing to sell to cash out and hedge).

Furthermore, as the bulls attempt to drive the price up, the funding cost remains high, with this upward movement being entirely leveraged-driven and reflected in recent (yet short-lived) ATH breaches.

You may also like

AI Trading's Ultimate Test: Empower Your AI Strategy with Tencent Cloud to Win $1.88M & a Bentley

AI traders! Win $1.88M & a Bentley by crushing WEEX's live-market challenge. Tencent Cloud powers your AI Trading bot - can it survive the Feb 9 finals?

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…

Average Bitcoin ETF Investor Turns Underwater After Major Outflows

Key Takeaways: U.S. spot Bitcoin ETFs hold approximately $113 billion in assets, equivalent to around 1.28 million BTC.…

Japan’s Biggest Wealth Manager Adjusts Crypto Strategy After Q3 Setbacks

Key Takeaways Nomura Holdings, Japan’s leading wealth management firm, scales back its crypto involvement following significant third-quarter losses.…

CFTC Regulatory Shift Could Unlock New Opportunities for Coinbase Prediction Markets

Key Takeaways: The U.S. Commodity Futures Trading Commission (CFTC) is focusing on clearer regulations for crypto-linked prediction markets,…

Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In?

Key Takeaways Hong Kong’s financial regulator, the Hong Kong Monetary Authority (HKMA), is on the verge of approving…

BitRiver Founder and CEO Igor Runets Detained Over Tax Evasion Charges

Key Takeaways: Russian authorities have detained Igor Runets, CEO of BitRiver, on allegations of tax evasion. Runets is…

Crypto Investment Products Struggle with $1.7B Outflows Amid Market Turmoil

Key Takeaways: The recent $1.7 billion outflow in the crypto investment sector represents a second consecutive week of…

Why Is Crypto Down Today? – February 2, 2026

Key Takeaways: The crypto market has seen a downturn today, with a significant decrease of 2.9% in the…

Nevada Court Temporarily Bars Polymarket From Offering Contracts in the State

Key Takeaways A Nevada state court has temporarily restrained Polymarket from offering event contracts in the state, citing…

Bitcoin Falls Below $80K As Warsh Named Fed Chair, Triggers $2.5B Liquidation

Key Takeaways Bitcoin’s price tumbled below the crucial $80,000 mark following the announcement of Kevin Warsh as the…

Strategy’s Bitcoin Holdings Face $900M in Losses as BTC Slips Below $76K

Key Takeaways Strategy Inc., led by Michael Saylor, faces over $900 million in unrealized losses as Bitcoin price…

Trump-Linked Crypto Company Secures $500M UAE Investment, Sparking Conflict Concerns

Key Takeaways A Trump-affiliated crypto company, World Liberty Financial, has garnered $500 million from UAE investors, igniting conflict…

AI Trading's Ultimate Test: Empower Your AI Strategy with Tencent Cloud to Win $1.88M & a Bentley

AI traders! Win $1.88M & a Bentley by crushing WEEX's live-market challenge. Tencent Cloud powers your AI Trading bot - can it survive the Feb 9 finals?

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…