PAXG Token Overview: What Is PAX Gold and Is PAXG Crypto Worth Investing In?

As digital assets continue to evolve, tokenized real-world assets (RWAs) are becoming a key bridge between traditional finance and blockchain markets. Among these, PAX Gold (PAXG) stands out as one of the most established and regulated gold-backed crypto assets, offering investors direct exposure to physical gold through a blockchain-based structure.

This article explores what is PAX Gold, how the PAXG token works within Paxos’ broader tokenization strategy, how it compares with traditional gold investments, how the PAX gold price tracks physical gold, and whether PAXG is worth investing in. It also explains how to buy and trade PAX Gold efficiently through WEEX PAXG markets.

What Is PAX Gold (PAXG)?

PAX Gold (PAXG) is a regulated, asset-backed digital token issued by Paxos Trust Company, a New York State–chartered trust company regulated by the New York Department of Financial Services (NYDFS).

Each PAXG token represents one fine troy ounce of physical gold, stored in LBMA-accredited vaults in London. The underlying gold takes the form of 400-ounce “Good Delivery” bars held in Brink’s vaults. Token holders have direct, legally enforceable ownership rights to specific gold bars, with allocation details verifiable on-chain.

For investors asking what is PAX gold?, the key distinction is that PAXG is not a synthetic or derivative product. It is fully backed by allocated physical gold, with monthly attestation reports published by Withum and made publicly available through Paxos.

PAXG and Paxos’ Tokenization Strategy

PAX Gold plays a central role in Paxos’ broader tokenization strategy, which focuses on bringing traditional financial assets on-chain in a compliant and transparent manner. Paxos is also the issuer of regulated stablecoins and provides settlement infrastructure for institutional clients.

Through the PAXG token, Paxos demonstrates how physical commodities such as gold can be digitized, fractionalized, and traded globally while remaining within established regulatory frameworks. This approach has made PAX Gold particularly attractive to institutions, professional traders, and regulators seeking compliant exposure to tokenized assets.

In 2025, amid increased U.S. regulatory scrutiny of stablecoins and asset-backed tokens, Paxos continued to be referenced in policy discussions due to its full-reserve model and transparent audit framework. PAX Gold has been cited in regulatory commentary as a compliant example of tokenized gold.

PAX Gold vs Traditional Gold Investment

Compared with physical gold and gold ETFs, PAX Gold offers a distinct structural profile:

Aspect | Physical Gold | Gold ETFs | PAXG Token |

Ownership | Direct | Indirect | Direct |

Storage | Self-managed | Managed by issuer | Institutional vaults |

Trading Hours | Limited | Market hours | 24/7 |

Fractional Trading | No | Limited | Yes |

On-chain Transparency | No | No | Yes |

PAXG removes the operational friction associated with physical gold storage while avoiding the indirect exposure common in ETF structures. By settling on blockchain infrastructure, the PAXG token allows continuous trading and near-instant transferability without sacrificing physical backing.

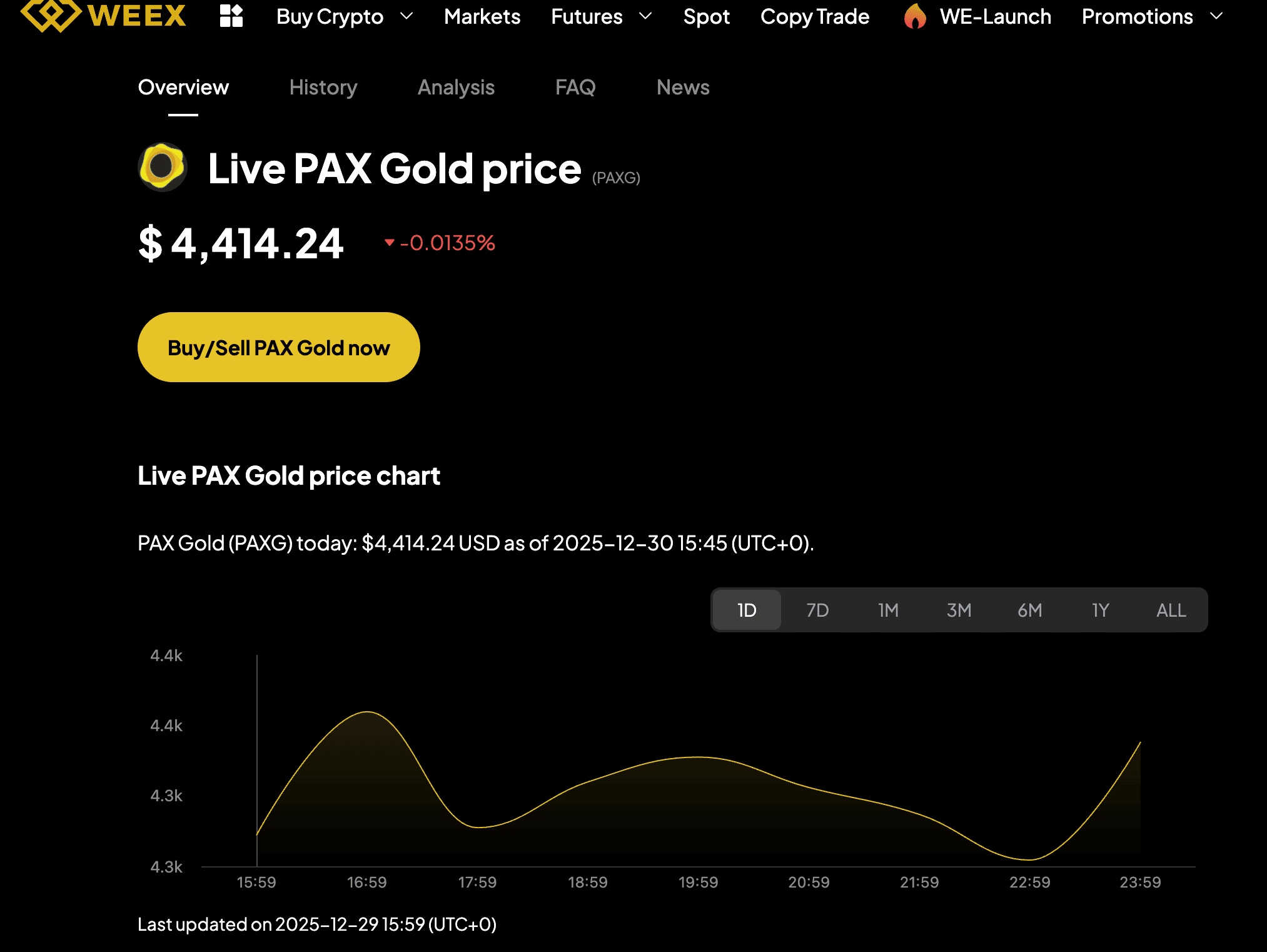

PAX Gold Price and PAXG Coin vs Gold Price

The PAX gold price is designed to closely track the global spot price of gold, as each PAXG token is backed by one fine troy ounce of physical gold. In practice, small deviations between the PAXG coin vs gold price can occur due to exchange liquidity conditions, transaction costs, and short-term demand fluctuations.

As of late 2025, PAX Gold’s total market capitalization surpassed 1.6 billion USD, with prices moving in line with spot gold as it traded above the 4,500 USD per ounce range. These dynamics reinforce PAXG’s role as a digital representation of gold rather than a speculative proxy.

Over time, pricing discrepancies tend to remain limited, making the PAXG token a reliable instrument for gold exposure within crypto markets.

Is PAX Gold a Good Investment?

Whether PAX Gold is a good investment depends on an investor’s objectives and risk profile. PAXG is commonly used as a portfolio stabilizer, an inflation hedge, and a diversification tool within crypto-native portfolios.

Key considerations include:

- Regulatory strength, supported by NYDFS oversight and monthly audits

- On-chain transparency and verifiable physical backing

- Liquidity across centralized and decentralized venues

- Exposure to macro-driven gold price volatility

By the end of 2025, on-chain and derivatives data showed increasing institutional engagement. Exchange hot wallets held approximately 920,000 ounces, representing around 74 percent of circulating supply. Derivatives markets reflected moderate bullish sentiment toward gold, while cross-chain flows to Solana-based liquidity pools indicated growing demand for yield-generating strategies using PAXG.

However, investors should also consider redemption fees and broader macroeconomic factors affecting gold prices when evaluating long-term holding strategies.

How to Buy Paxos Gold (PAXG) on WEEX

WEEX provides a centralized trading environment designed to support efficient execution and risk management for asset-backed tokens such as PAX Gold.

To trade WEEX PAXG markets, users typically follow these steps:

- Create an Account: Sign up for a WEEX account by logging in the official website.

- Complete Verification: Secure your account by completing the necessary identity verification steps.

- Deposit Funds: Add funds using your preferred payment method.

- Search for PAXG Coin: Use the search function to find PAXG/USDT on WEEX.

- Place Your Order: Select the amount of PAXG token you want to buy and submit your order.

- Confirm Purchase: Review your details and confirm the purchase.

WEEX integrates advanced risk control systems and deep liquidity support from leading liquidity providers, enabling efficient access to the PAXG token without the complexities of physical gold custody.

Conclusion: PAX Gold and WEEX as a Digital Gold Trading Solution

PAX Gold represents one of the most mature implementations of tokenized gold, combining physical backing, regulatory oversight, and blockchain efficiency. For investors exploring what is PAX gold?, tracking the PAX gold price, or evaluating PAXG coin vs gold price dynamics, PAXG offers a transparent and institution-ready solution.

When traded through WEEX PAXG markets, investors gain access to professional-grade infrastructure, strong liquidity, and reliable execution. Together, PAX Gold and WEEX provide a practical framework for integrating gold exposure into modern crypto portfolios.

You may also like

Introducing ZKsync: Complete Guide to $ZK and Airdrop Opportunities

ZKsync ($ZK) is the Layer-2 datachain, a scaling solution using zero-knowledge rollup, which is also known as zk-rollup. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 ZKsync airdrop before Feb.09, 2026!

What is Robinhood Markets Tokenized Stock (HOODON) Coin?

Robinhood Markets Tokenized Stock (HOODON), newly listed on WEEX Exchange as of February 2, 2026, provides a unique…

WEEX Adds HOODON/USDT: Robinhood Markets Tokenized Stock (Ondo) Coin Listing

WEEX Exchange has officially listed the HOODON/USDT trading pair, enabling crypto enthusiasts to trade Robinhood Markets Tokenized Stock…

What is Purch (PURCH) Coin

We’re thrilled to announce that the trading pair PURCH/USDT is now live on WEEX as of February 2,…

PURCH USDT Pair Live on WEEX: Purch (PURCH) Coin Listing

WEEX Exchange is thrilled to announce the listing of Purch (PURCH) coin, opening up the PURCH USDT trading…

How to Make Money in Crypto in 2026? 4 Main Methods Explained

This guide breaks down the four main methods that are helping thousands of people earn in crypto right now. We'll focus especially on two popular approaches offered by leading platforms: WEEX Auto Earn for stablecoins and WEEX Staking for various cryptocurrencies.

PURCH Coin Price Prediction & Forecasts for February 2026: Fresh Listing Sparks Potential Rally

PURCH Coin has just hit the scene with its listing on WEEX Exchange today, February 2, 2026, opening…

How to Buy Your First Bitcoin Safely in 2026: Complete Beginner's Anti-Scam Guide

Before buying anything, you should know what you're investing in. What is bitcoin? It's digital money that works without banks or governments. Think of it as "digital gold" that you can send anywhere in the world, anytime. Only 21 million will ever exist, which makes it valuable like rare metals.

What Makes an AI Trading Bot for Crypto Stand Out: Lessons from WEEX’s Innovations

As of February 2, 2026, the crypto world is buzzing with advancements in AI trading bots, especially with…

What is CLAWNCH (CLAWNCH) Coin?

We are thrilled to announce that the trading pair CLAWNCH/USDT is now available on WEEX, with trading having…

CLAWNCH USDT Trading Debuts on WEEX: CLAWNCH Coin Listed

WEEX Exchange is thrilled to announce the listing of CLAWNCH Coin (CLAWNCH), a promising token on the Base…

CLAWNCH Coin Price Prediction & Forecasts for February 2026: Potential Rally as Base Network Adoption Grows

CLAWNCH Coin has just hit the scene, launching on the Base network on January 31, 2026, with a…

BNB 2026 Value Forecast: Assessing the Resilience of the Binance Ecosystem

Explore the expert BNB price forecast for 2026 and a deep dive into the Binance ecosystem's long-term sustainability. This analysis covers opBNB technical milestones, institutional outlooks from $850 to $2100, and strategic investment insights for the post-CZ era.

Avalanche (AVAX) 2026 Outlook: Is This the Most Undervalued Institutional Public Chain?

Explore why Avalanche (AVAX) is positioned as the most undervalued institutional public chain in 2026. Discover how its Subnet architecture and RWA leadership are redefining the future of digital finance.

Will Stablecoins Replace Traditional Payments in 2026? USDT and USDC Latest Trends

With the stablecoin market cap exceeding $305 billion, will they finally replace traditional payments in 2026? This report analyzes the latest USDT vs. USDC trends, institutional adoption, and the rise of AI-driven on-chain settlements.

Polymarket Alternatives: 2026 Prediction Market Outlook

Explore the 2026 prediction market landscape as Polymarket faces fierce competition from Kalshi, Robinhood, and Opinion. Discover which platform offers the best accuracy, how decentralized intelligence is replacing traditional media, and the key alternatives for crypto investors in this 2026 outlook.

Asset Tokenization 2026: How Close are Stocks, Bonds, and Real Estate to the Blockchain?

Explore the Asset Tokenization 2026 landscape. Learn how stocks, bonds, and real estate are moving on-chain with SEC compliance and AI agents. See the latest RWA data and market trends for 2026.

WEEX Futures New Listing: FUTU, RDDT, JD, and DFDV USDT Pair

WEEX lists Futu Holdings (FUTU), Reddit (RDDT), JD.com (JD), and DeFi Development (DFDV) USDT perpetual contracts. Trade stock-based futures with low fees today.

Introducing ZKsync: Complete Guide to $ZK and Airdrop Opportunities

ZKsync ($ZK) is the Layer-2 datachain, a scaling solution using zero-knowledge rollup, which is also known as zk-rollup. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 ZKsync airdrop before Feb.09, 2026!

What is Robinhood Markets Tokenized Stock (HOODON) Coin?

Robinhood Markets Tokenized Stock (HOODON), newly listed on WEEX Exchange as of February 2, 2026, provides a unique…

WEEX Adds HOODON/USDT: Robinhood Markets Tokenized Stock (Ondo) Coin Listing

WEEX Exchange has officially listed the HOODON/USDT trading pair, enabling crypto enthusiasts to trade Robinhood Markets Tokenized Stock…

What is Purch (PURCH) Coin

We’re thrilled to announce that the trading pair PURCH/USDT is now live on WEEX as of February 2,…

PURCH USDT Pair Live on WEEX: Purch (PURCH) Coin Listing

WEEX Exchange is thrilled to announce the listing of Purch (PURCH) coin, opening up the PURCH USDT trading…

How to Make Money in Crypto in 2026? 4 Main Methods Explained

This guide breaks down the four main methods that are helping thousands of people earn in crypto right now. We'll focus especially on two popular approaches offered by leading platforms: WEEX Auto Earn for stablecoins and WEEX Staking for various cryptocurrencies.